Account Login

Don't have an account? Create One

Not many know about CIBC’s connection to Atlantic Canada. Today one of North America’s leading financial institutions and based in Ontario, the origins of the Canadian Imperial Bank of Canada (CIBC) date back almost 200 years to the Halifax Banking Company.

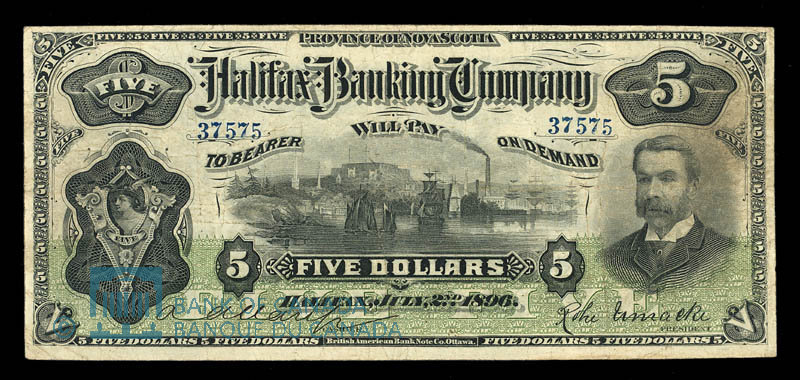

Halifax Banking Company

The Halifax Banking Company was founded in 1825 by eight well-known locals, becoming the first bank in Nova Scotia. After their charter was denied, the bank successfully operated as a private company for 47 years due to the influence and wealth of its founders. Eventually receiving a bank charter in 1872, the Halifax Banking Company incorporated and began expanding to 16 offices outside of Halifax.

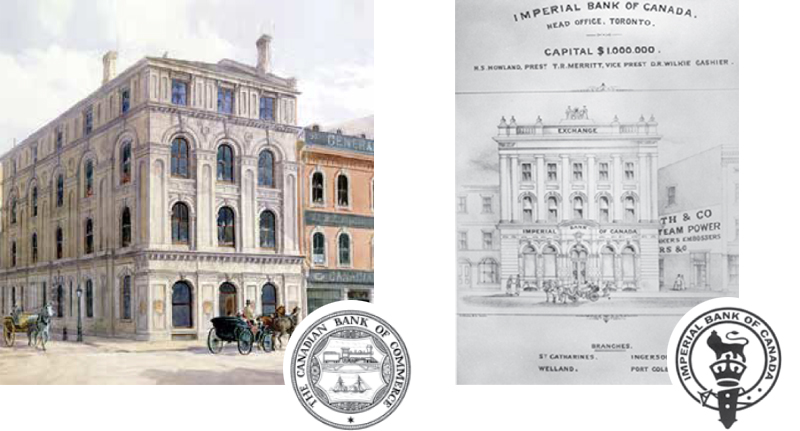

In 1903, the Halifax Banking Company merged with the Canadian Bank of Commerce (‘The Commerce’), helping it round out its presence in the Maritimes.

Two become one

The Commerce was founded in 1867 when a group of businessmen acquired a charter from the inoperative Bank of Canada. The bank grew quickly, opening new branches across Ontario and through acquisition. The Commerce merged with the Bank of British Columbia in 1901, followed by the Halifax Banking Company and five other Canadian banks, including the Merchants Bank of Prince Edward Island.

Another prominent bank at the time was the Imperial Bank of Canada. Founded in 1873, the Imperial bank built a strong presence in Ontario and began growing outside the province through acquisition.

In 1961, the Canadian Bank of Commerce and The Imperial Bank of Canada merged to form CIBC. The merger marked Canadian history as the largest to occur between two chartered banks.

Serve clients better

As a single corporation with 15,000 employees, CIBC started with a mission to serve its customers better. With that in mind, CIBC was the first Canadian bank to create a floating bank (serving clients in remote settings on a travelling ship), 24-hour cash dispensing (changing the industry in Canada) and flying bank services (serving clients by plane). The bank continued to grow over the years, including international expansion to Singapore and China throughout the ‘70s.

Another significant milestone occurred in 1988 when CIBC purchased 65 per cent ownership of Woody Gundy to round out its investment services. Later renamed CIBC Wood Gundy, this subsidiary of the bank eventually became the largest Canadian stock brokerage firm after CIBC also acquired Merril Lynch Canada in 1990.

CIBC continued to innovate over the years and grow through partnerships and acquisitions.

Today, CIBC is one of the top five largest banks in Canada, with 45,282 employees and 11 million clients. With international reach today, the beginnings of CIBC date back 197 years to Nova Scotia.

Atlantic Canadian origins, expanded worldwide.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel