Account Login

Don't have an account? Create One

The provincial and federal governments have made no bones about the fact they want to see new electricity infrastructure built and hydrogen production very quickly brought online. Budget 2023 from the Government of Canada includes tax credits to speed hydrogen developments, and more, potentially through the Canada Infrastructure Bank and Canada Growth Fund, atop actions at the provincial level. Companies are now pouring over the finer details, to see what exactly applies, as they plan next steps.

The federal government is offering up a Clean Technology Investment Tax Credit, Clean Technology Manufacturing Investment Tax Credit, a Clean Electricity Investment Tax Credit and Clean Hydrogen Investment Tax Credit. They collectively are expected help draw eyes and investment to hydrogen projects proposed for Atlantic Canada.

As a rule of thumb, the new credits cannot be applied on top of one another. However, in this region, an existing 10 per cent Atlantic Investment Tax Credit can be stacked on top of whatever new credit is being applied.

Credit specifics

Hydrogen producers are proposing sizable builds in new, renewable power generation to feed their proposed hydrogen and ammonia production facilities. According to Department of Finance officials, there is help for this part of their development plans in either the 30 per cent Clean Technology Investment Tax Credit or the lesser Clean Electricity Investment Tax Credit, the latter being a 15 per cent refundable credit. Both are said to support “non-emitting” electricity generation systems (including renewables, but also—by Finance definition—nuclear or natural gas with carbon capture), as well as applying to certain electricity storage systems and equipment tied to electricity transmission between provinces. Finance says it is assessed on a property-by-property basis.

There are some differences between the two. The lesser electricity credit is open to large hydro and the larger credit could go to small hydro of under 50 megawatts of generating capacity; the lesser credit could go to refurbishment of large nuclear facilities, while the greater credit could go to small-modular reactor developments. On early review, there was no clear divide when it comes to wind and solar farms (this will be edited to include any clarification there).

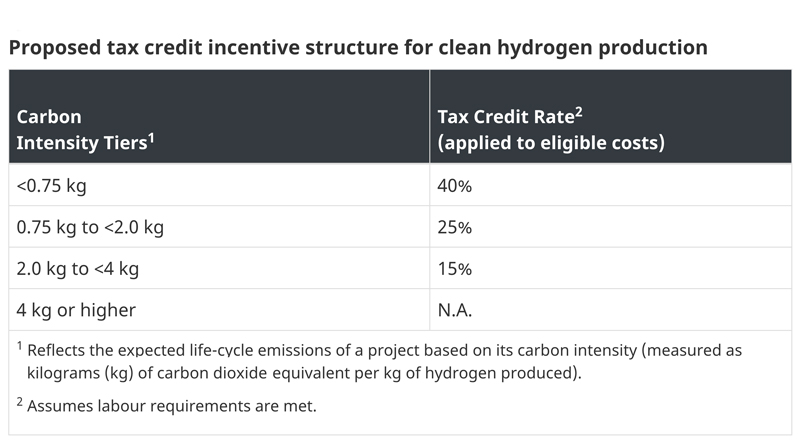

Once you have the electricity you need at the ready, the next piece to consider is hydrogen production. The Clean Hydrogen Investment Tax Credit comes in two parts. The first is 15-40 per cent coverage on eligible project costs involving equipment specifically for hydrogen production. The percentage is determined by the overall project, based on the carbon intensity of related greenhouse gas emissions, specifically upstream emissions as verified by Environment Canada, with natural gas-fed hydrogen projects receiving less support.

The calculations on carbon intensity for the hydrogen credit become complex since they take into account any reliance on large purchases of electricity from a public grid, if used to help cover production plant needs. For hydrogen producers supporting their projects through the rapid build of their own power supplies, the carbon intensity calculations also consider emissions they would displace when excess from their generators is sold into a linked grid otherwise reliant on fossil fuels.

Hydrogen projects in Atlantic Canada are being designed almost entirely for export. They’re likely to take advantage of the added benefit of the second part of the new tax credit, that being a 15 per cent credit applicable specifically to equipment for production of ammonia, a final product safe for shipping.

If you’re not too scrambled yet, you might pick up that the credits are more complicated than a single, certain, blanket credit on a given development’s total capital cost. Apart from differences in carbon intensity affecting the level of the credit, project owners may claim the hydrogen tax credit on their hydrogen production while—particularly for would-be producers building for their own electrical power—leaning on other credits to help with their total project outlay.

The hydrogen credit notably doesn’t cover costs for feasibility studies, front-end engineering and design studies, or operating expenses. It applies to the cost of purchasing and installing eligible pieces of equipment and is claimed as equipment becomes available for use, notably all before 2034, when the main credits start to be phased out. Basically, hydrogen proponents will have no choice but to get a move on if they want to be certain of capitalizing on the new, federal financial support.

Competitive by nature

Regardless of the challenges in the specifics for the proposed new industry and the timeline, the incentives are being openly welcomed by project proponents.

“(The) budget will help Canadian clean energy projects secure the coveted first-mover advantage in a global industry that is fiercely competitive,” stated EverWind CEO Trent Vichie, in a statement following the budget’s release. Everwind is arguably the frontrunner in what has become a regional race to commercial hydrogen production. The company secured environmental approval for the start of its hydrogen and ammonia export project near Port Hawkesbury in February.

Pattern Energy has been investigating potential projects and actively pursuing development of Argentia Renewables, with a planned hydrogen and ammonia production and export facility on Placentia Bay, Newfoundland and Labrador. In a statement offered in response to questions from Atlantic Business Magazine, Pattern Energy’s Canada country head Frank Davis said the company supports the federal government’s efforts toward making Canada a competitive place to make and export hydrogen. “We look forward to working further with government to ensure our project’s competitiveness and long-term success,” he stated. The company hasn’t yet registered for environmental assessment but is hoping for environmental approval on the first phase of its Placentia area project in 2024.

World Energy GH2 director John Risley offered a similar but even stronger sentiment on the budget benefits. “Budget ’23 sets the right conditions for the establishment of a multi-billion-dollar clean hydrogen sector in Atlantic Canada,” he said, in a statement. The company has stood out as an early mover in Newfoundland and Labrador with its project in Western Newfoundland and is currently into environmental review. The next step will be the filing of a detailed environmental impact statement.

They don’t stand alone. There is a growing list of would-be hydrogen producers in the region and plenty of variation in stages of development and project specifics.

Not without cost

The latest hydrogen incentives are not without cost. The final tally will be dependent on uptake and construction proceeding across the country, something the federal government has been challenged to predict when it comes to new “clean economy” projects. However, the government’s current expectation is the Clean Electricity Investment Tax Credit will cost $6.3 billion over four years starting in 2024-25, and an additional $19.4 billion from 2028-29 to 2034-35. The Clean Hydrogen Investment Tax Credit is expected to cost $5.6 billion over five years, beginning in 2023-24, and an additional $12.1 billion from 2028-29 to 2034-35.

Benefits will come at a lag, by nature of where developments stand at the moment, though post-budget commentary from Scotiabank analysts suggests the “clean economy” spending generally be viewed positively since it, “should help enhance Canada’s growth potential over the medium term.”

Analysts from TD highlighted the hydrogen credit as encouragement for Atlantic Canadian producers in particular, who may have feared faster movement in the U.S. based in part on the Inflation Reduction Act and a standing offer now of a $3/kg credit for clean hydrogen production there.

“Whether or not Canada’s investment tax credit can compete purely on a cost basis is uncertain for now,” the analysts stated. They went on to emphasize Canada’s hydrogen alliance with Germany, committed to enabling investment in hydrogen projects. “The (Canadian) investment tax credit may never have been intended to compete with the U.S., but rather build on the optimism among several east coast provinces hoping to take advantage of the trade agreement,” they added.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel