Account Login

Don't have an account? Create One

Once upon a time, Halifax tied Toronto and Montreal as the heart of Canadian banking. How did it happen—and when did those commercial tides turn?

In the early 19th century, Halifax was a garrison town in transition. For decades, the fate of the city had swung from foreign conflict to foreign conflict: the War of Independence, the Napoleonic Wars, the War of 1812—conflicts that brought waves of new immigrants and shaped Halifax’s economic outlook.

But in the peace that set in after 1815, a new kind of domestic prosperity took hold. Local capitalists sought to cash in on Halifax’s location at the eastern edge of North America to build fortunes based on shipbuilding, fishing, West Indies trade and timber exports to Britain.

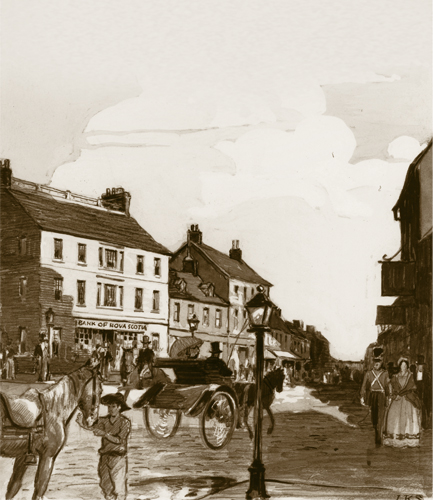

For these colonial merchants, fulfilling a vision of Halifax as the dominant port in the region also required another industry: banking, to finance the projects upon which Halifax’s wealth depended. These early banks, founded in buildings not far from the bustling warehouses lining Upper and Lower water streets, would go on to become the largest in the colony—and eventually, the country—granting Halifax an early foothold in the race to establish Canada’s commercial centres.

Today, however, when people think of banking in Canada, they’re more likely to envisage Bay Street than Barrington. But historians say Halifax’s journey from the centre of Canadian banking to the periphery, mirrors Canada’s economic history more broadly—a history that has lessons for the present-day fortunes of a society still in flux.

Experts in the history of Canadian banking are thin on the ground, and Joe Martin knows that better than most. In 2020, Martin (who has an honorary doctorate but not, as he says, an ‘earned’ one) was contacted by McGill University to act as an external examiner for a PhD student’s thesis on Canadian banking. There was no one else with his level of expertise—much of the writing that has been done on the subject, he says, is the product of American scholars.

Nonetheless, Martin, who is founding and current president of the Canadian Business History Association (CBHA) and co-author of the book From Bay Street to Wall Street, comparing Canadian and American financial history, says banking is more central to the creation of Canada than it was to the establishment of our southern neighbour. Understanding how this relates to the history of banking in Atlantic Canada—and by extension, the economic history of the region—requires (bear with me) a rapid-fire tour through the annals of the early legislation that made up this country.

In 1867, the four colonies of British North America made the decision to unite, laying out the structures that would govern the new confederation. These structures weren’t solely governmental; banking was also central to the discussion, Martin says. “In the [1867] Canadian Constitution, not only was [the banking system] established in every draft, but banking was there from the very beginning.” By contrast, nowhere in the U.S Constitution is banking mentioned. This matters, Martin says, because it shows that an assumption of national banking was built into the Canadian system.

Continue reading this story: click below to login/subscribe

Login or SubscribeComment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel