Account Login

Don't have an account? Create One

At a moment in time, where the combined knowledge of humans is on a device in your pocket, many businesses have had to change. Financial services are no exception,” observes Colin White, Portfolio Manager at WLWP Wealth Planners | iA Private Wealth.

The industry is faced with the challenge of finding new ways to provide value to clients. “Many advisors made a living, some still do, selling investments that paid an upfront commission as high as five per cent or higher,” White explains. “There have been many business models that have fallen by the wayside over the years through market forces or regulatory change.”

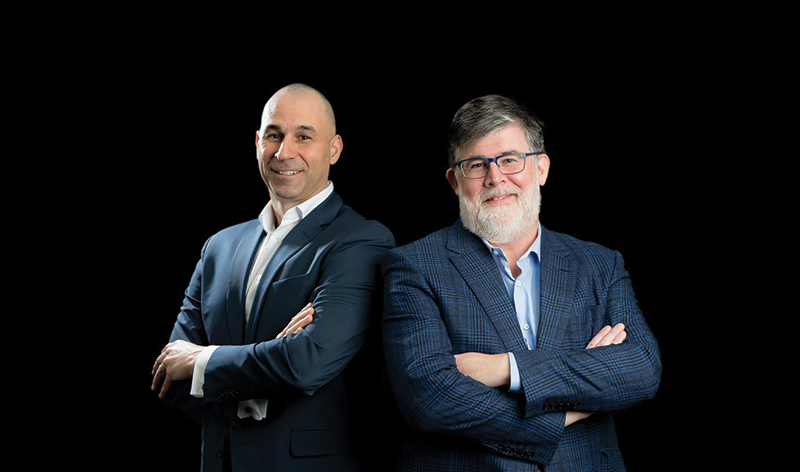

Portfolio Managers Dan LeBlanc and Colin White saw the writing on the wall. The industry had changed; the solution, they decided, was to build a team. “For what we had in mind, it was unlikely that one or two advisors would have all the skills required to deliver on all aspects of a well-rounded investment management and financial planning practice,” LeBlanc says.With one assistant, Dan and Colin have grown WLWP Wealth planners to seven offices across Canada, with 31 people serving 2,000+ households through acquisitions and organic growth. While wealth management makes up much of what they do, they also provide a variety of complementary services through their sister company, WLWI Inc. As a result, they have become a go-to destination for advisors planning to retire or build a succession plan.

White says two aspects of their business set them apart. The first is the depth and breadth of the tools and expertise they bring to the table. With a highly accredited and experienced team, they are licensed to deal in most investment products available in the market and offer discretionary investment management. This allows WLWP to document the clients’ risk tolerance and goals more thoroughly than is standard for regular investment accounts and then manage the account on a discretionary basis.

“In this type of account, we don’t have a requirement to contact clients and describe the relevance of the Japanese yield curve or some other deeply technical issue, and have them approve a trade,” White says.

This enables WLWP to react promptly to what is going on in the market without inconveniencing the client. This type of account is fee-based, meaning the fee is calculated on the assets within; they are not paid for transactions, nor are they paid by any of the companies or investment products in the account. The only source of income from the account is the fee that is charged. If the account goes up, their revenue goes up, ensuring alignment with the clients’ interests.

The other thing that sets them apart is more unique. “Our people are rare and make all the difference,” White says. “No one on the team is on commission, and bonuses are not tied to any sales objective. The only thing that matters to our team is our clients’ best interest. The primary activity that is tracked internally is client contact. Have we been in touch with our clients as much as they would like us to be? When we track that one piece, all the rest looks after itself.”

The strategy has worked well for them. The pandemic accelerated changes already underway and spurred new changes to how WLWP interacts with clients. Over the past few months, they have spent a lot of time building out and improving their online content. With regular video updates and a weekly podcast, the team is working overtime to be available to their clients in the ways they want. •

This information has been prepared by White LeBlanc Wealth Planners who is a Portfolio Manager for iA Private Wealth. Opinions expressed in this article are those of the Portfolio Manager only and do not necessarily reflect those of iA Private Wealth Inc. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel