Account Login

Don't have an account? Create One

FOUNDED TO SUPPORT THE ACADIAN COMMUNITY, Assumption Life has been in operation for 120 years and counting. What started as a scholarship fund has grown into a national organization with a growing suite of insurance and investment products. Currently executing a new strategic plan, it appears that it’s just the beginning for the insurance and investment company based in New Brunswick.

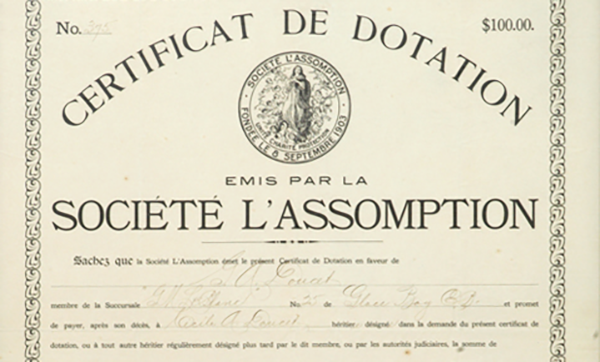

In the 1890s, many Acadians migrated from New Brunswick to Waltham, Massachusetts in search of work. As they began to make a living and settle in the area, leaders within the community felt it prudent to start saving to invest in the education of future generations. This led to the establishment of Société l’Assomption, a fraternal benefit society, and its scholarship fund in 1903.

Soon after, the organization also established a life insurance product; company archives show its oldest certificate dates back to 1906. After a decade of growth, in 1913 the Société l’Assomption and many of its members returned home to New Brunswick and company headquarters moved to Moncton.

As the organization set roots in home soil, the Société l’Assomption continued to grow and reached 10,000 members in 1929. In the late 1960s, the organization adopted the name Assumption Life and restructured from a fraternal society to a mutual insurance company. In 1970, Assumption Place was constructed on Main Street in downtown Moncton, which remains Assumption Life’s head office today.

Over time, Assumption Life expanded its suite of products beyond life and group insurance. In 1991, its subsidiary Louisbourg Investments was established, which led to personal investment, retirement savings and commercial and mortgage loan services. In 2007, Assumption Life became a national company, which allowed the organization to grow business across the country.

In 2013, Assumption Life launched its online sales platform, Lia, which allows life insurance applications to be submitted digitally and processed much faster than physical documents sent by mail. This new technology has helped Assumption Life grow its customer base across Canada. According to Réjean Boudreau, vice president of client experience, Assumption Life was the first company in Canada to sell life insurance from coast to coast.

Thomas Raffy, marketing and communications director commented: “We’re recognized for our innovative technology. Our agile mindset allows us to provide the best solutions for our advisors and ultimately our clients.”

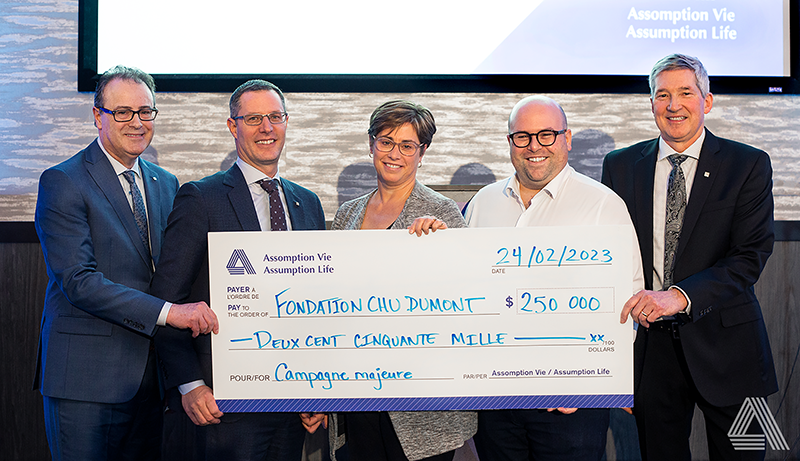

Today, Assumption Life operates from Moncton, N.B. with about 250 employees. Now a national company with clients across the country, the organization is currently executing the first year of its latest strategic plan to grow its client base and product offerings.

Commenting on the organization’s impact, Réjean Boudreau says: “Great plans are ahead. We plan to continue having a significant impact and investing in our community, not only in Atlantic Canada but everywhere that we are doing business across the country.”

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel