Account Login

Don't have an account? Create One

Corner Brook Pulp and Paper Limited (CBPP), operators of the mill in Corner Brook, an anchor in the economy of Western Newfoundland, has landed a plum deal on power sales to Newfoundland and Labrador Hydro, with direction from the provincial government. It’s the kind of agreement that might only be afforded to a company operating a business considered pivotal to the province’s forestry sector.

The deal comes after the company approached the government, while struggling with newsprint markets. CBPP already has a loan outstanding with the Government of Newfoundland and Labrador.

The new, time limited power contract is estimated to be worth about $22 million over six months, running February 1 through to July 31 of this year. It will see N.L. Hydro buying 80,000 megawatt hours (MWhs) of electricity from CBPP’s hydroelectric plant in Deer Lake, at $275 per MWh (for the $22 million total). There is an option to renew.

CBPP already has what’s known as a “capacity assistance agreement” with N.L. Hydro, one approved in December by the Public Utilities Board (PUB), the province’s utilities regulator. That agreement sets terms for Hydro’s access to up to 90MW of CBPP’s company-owned power production capacity. Such standing agreements can be valuable, to avoid disputes and delays in times of acute need on the province’s main grid.

The new arrangement is something different. It will see CBPP, as part of regular operations, steadily feed energy to N.L. Hydro. The sales first became public on Friday, March 15, only because of press releases issued by both CBPP’s parent company, Kruger Inc., and the Government of Newfoundland and Labrador.

Kruger took the moment to also highlight a task force in the company assigned “to identify viable projects to diversify CBPP’s production in the field of wood-based bioproducts.” That’s a big category but includes wood pellets, biochar (a charcoal like product that can be used in agriculture), various biochemicals and biofuels. The mill’s paper production continues in the meantime. Both the new power arrangement and statements on diversification are about repositioning the mill for a sustainable future, according to company reps.

Senior vice president and COO for Kruger’s pulp and paper division, Roman Gallo told Atlantic Business Magazine operations at the Corner Brook mill are “ok” right now. The mill was put into a week-long shutdown in December 2023 in large part, by Gallo’s own description, based on the order book around that time. However, he suggested, newsprint orders have picked up. The predominant issue of late has been pricing at “kind of historically low levels,” he said.

The company approached the province. It was, “when we recognized that the markets were really starting to become concerning,” Gallo said, “we asked them if there was an opportunity to do more in the short term and that’s what started the conversation.”

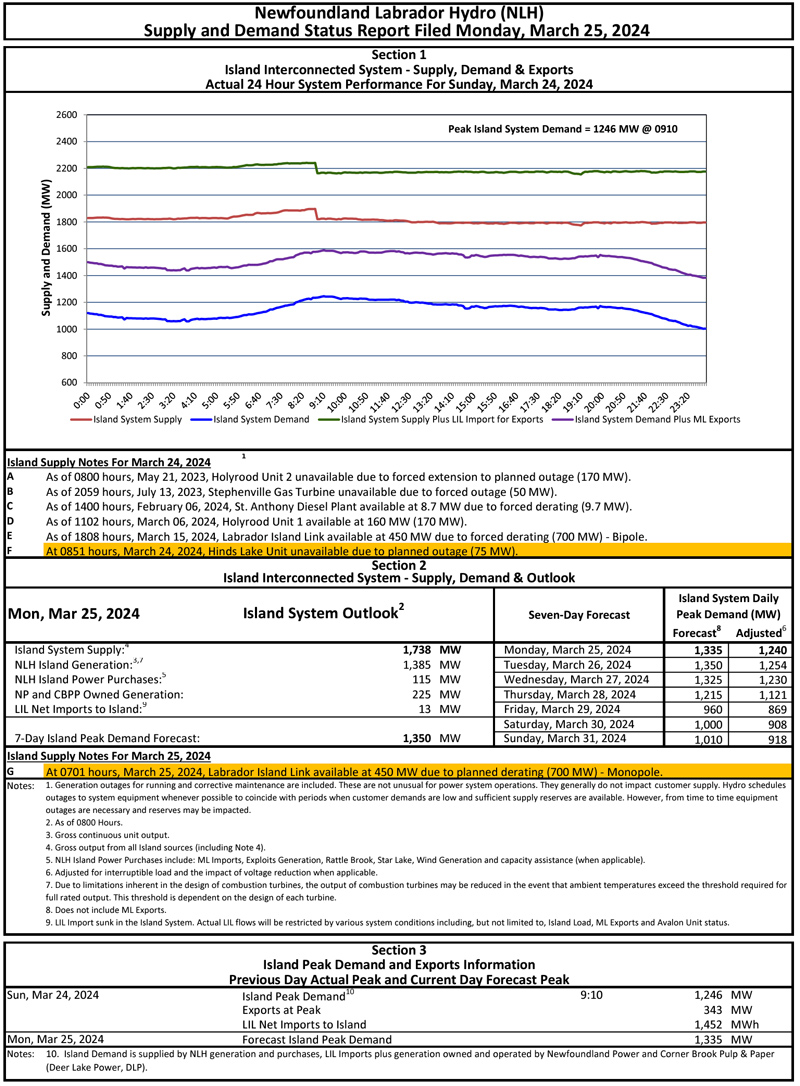

The starting point for the new power arrangement wasn’t a need within Newfoundland and Labrador Hydro, with hydro going to CBPP. The public utility has not stated it needed additional power supply beyond what is already under contract or existing in-house. There is also no evidence in the public records of need to cover power demand.

The PUB reports daily on available electricity supply and demand. While events like a multi-day storm in early March have tightened electricity supply at times this winter, demand overrunning supply was not reported as a fear of Hydro leadership. Even in the forementioned storm, Hydro continued power exports. By Hydro’s own readiness standards, the utility is required to plan internally so that you could factor out the equivalent of the entirety of the production capacity at the CBPP plant and still supply the island power grid without concern. More significantly, warmer spring temperatures have already started to arrive and there has been no sign of any need for the public utility to pay the cost of additional supply through July.

Historically speaking, under its last capacity assistance arrangement, N.L. Hydro spent under $2.7 million for help from CBPP’s power facilities over six months last winter, from November through April. The new contract is worth significantly more.

It all appears to contradict some of the comments on the new power deal to date. One example comes from an interview of Corner Brook MHA Gerry Byrne with NTV’s Don Bradshaw. Byrne said: “This is the purchasing of something which is needed by the grid. This is not a grant, not a contribution, not a freebie…”

Atlantic Business Magazine reached out to Byrne about the comment but received no response as of deadline.

Setting aside the basic question of electricity need, it really comes down to whether or not the power deal involves the sale of electricity at a fair price. Here, the company, government and N.L. Hydro are leaning into the cost of carbon and cost of power from Hydro’s own sources that would be otherwise used.

“While the price set in this agreement does not reflect current market value, it is aligned within the range of common carbon-based generation costs,” stated Hydro senior communications officer Jill Pitcher, in an emailed response to questions.

Gallo was asked about the “s” word—subsidy. He doesn’t agree with use of the term here (looking at the available information, Atlantic Business Magazine decided ‘indirect subsidy’ is appropriate).

“If it was a long-term agreement, I would agree with you. If you were looking at a multi-year agreement at that price, that would then become something of a significant concern. But the fact is we’re doing this only for a short period of time, six months,” he said.

“We’re doing it during a time when the capacity and power needs of the island are relying on their marginal cost supply,” he said, underscoring the idea use of the power from CBPP would mean less fossil fuel-based power.

“If you were looking at a multi-year agreement at that price, that would then become something of a significant concern.”

—Roman Gallo, Kruger

The power sales contract followed an order out of the provincial cabinet, on January 22. The public reveal of the arrangement made a point to note the new power sales will fall under N.L. Hydro’s unregulated business and not drive up overall power rates for ratepayers. However, Atlantic Business Magazine challenged, it did not mention taxpayers or state cheaper alternatives weren’t available.

For Hydro, any money paid out for any additional cost for power is money that would otherwise remain within the corporation, to either be applied to operations, with any number of options there, or be paid out to the shareholder (namely government coffers) down the line.

The new power deal isn’t the first time the government has been at the table with the company. In 2014, Newfoundland and Labrador was under a Progressive Conservative government when a $110-million public loan was issued to help support CBPP. The loan was to be repaid by way of quarterly payments, starting in 2019. However, the company stopped making those payments after just its first three. The company has made no payments on the loan since.

The total currently owed, with interest, is over $120 million. (The outstanding balance is just over $117 million, but per last year’s Public Accounts record, representative of the total only as of March 31, 2023. The up-to-date balance would include further interest accrued. Last year over year, that was $4 million -$5 million, suggesting the balance as of today’s date would land over $120 million.) The loan is secured by, among other things, the CBPP power assets.

The debt was under discussion before the new power arrangement was struck. According to both the company and response to questions to government, no changes have been made to the loan agreement.

Kruger recognizes the interest adding up.

“We’re making the decision right now that we’d rather invest in the facility than be paying down that debt,” Gallo said

He said, with full knowledge of the government, the focus for the company is on securing a stable future for CBPP.

“(The loan) was discussed. I mean, it was more of a point of all of us agreeing we know where we’re at, we know what we’re doing and we’re, I guess, for lack of a better word, ok with what we had done and what we have for a plan going forward,” he said.

Corner Brook Mayor Jim Parsons said he’s heard a lot of inflated opinions around the mill that sits in the heart of his town’s downtown through the years, in what he calls the “dance with industry” that he considers common to a lot of natural resource businesses. Mainly, he said he’s keeping a calm, broad view of the latest news. He expects the mill to weather recent troubles, especially given the province’s indications of support.

“I’m still very optimistic about the mill and I see a lot I guess of doom and gloom, rhetoric, coming from certain media and from people who don’t quite understand how the industry works,” he told Atlantic Business Magazine.

Based on past experiences, he said, the market has come around to “rebalance” after times of stress. The town has weathered past dips in business at the mill.

“I’m still very optimistic about the mill…”

—Corner Brook Mayor Jim Parsons

The temporary shutdown before Christmas also offered the company time for some maintenance and work on the plant infrastructure, he said. And the new power deal comes with fresh commitments to settling on a diversification plan for the future.

“I do think this isn’t simply a bailout of any kind,” he said.

Parsons said the mill still looms large in the local culture, remains pivotal to the local economy, but also is no longer the largest employer in town. It is an anchor tenant for the port, as an example but also a feeder to sawmills and other forestry sector business.

The mill has about 305 direct CBPP employees but provides for around 425 jobs. International newsprint exports from the province are valued at just under $175 million.

“This is a private company. They’re always going to do what’s best for the company first. I expect that. That’s not a cyncical take, that’s what they do. (…) Stability is the thing. We don’t want to see boom and bust,” he said.

The Government of Newfoundland and Labrador has stepped in before to help the beleaguered pulp and paper operation and it wasn’t the first step-in by a provincial government. It’s a familiar story for other provinces as well.

New Brunswick created an electricity subsidy for paper mills, as CBC reported, by having NB Power pay the mills elevated prices for electricity.

U.S. producers sought a trade inquiry under NAFTA in 2012, after the Nova Scotia government offered a $124-million financial aid package to the Port Hawkesbury Paper mill in Cape Breton.

CBPP was one of the Canadian producers thrown under the microscope while the provincial and federal governments fought against tariffs slapped on Canadian product by the U.S. Department of Commerce in 2017-18. The International Trade Commission voted to reduce then ultimately overturn what was being applied to shipments.

In more recent years, there has been no less concern about fair competition. Producers of paper products in India were bucking against imports in 2020, including imports from Canada, as the Globe and Mail reported. Notably, CBPP started shipping to India in an efforts to diversify its customer base beginning around 2018.

Any direct support from a provincial governments to paper product producers risk new trade battles.

Political opposition members have spoken briefly over the past week on the new CBPP power deal, but there was no broad awareness of the arrangement until the provincial government had issued its news release on March 15, being after the provincial legislature had shut down ahead of delivery of the annual budget. And the budget landed before a week of constituency days, then another two weeks afforded to the House for Easter break. What that means is, until April 15, there will be no Question Periods in the provincial legislature where political opposition could directly, publicly confront the Liberal government on the deal.

There are no active legislative committees in Newfoundland and Labrador regularly reviewing matters relating to the province’s natural resources and natural resource industries. However, once a year, a committee sits to review budget Estimates for related departments and the sessions have become an open door to questions. The date and time for the Estimates review session for 2024-25 for the Department of Fisheries, Forestry and Agriculture, plus other departments, remained “TBD” as of deadline.

Back at the mill, it’s steady forward.

“We’ll take this six months at a time and we’ll get back with the government and we’ll say, ‘Alright, here’s the good work that’s been accomplished, here’s the vision as we continue to go forward on securing the circular economy on the western side of the island,’ and we’ll make whatever best decisions we can make at that point in time, with the information we’ll learn between now and then,” Gallo said.

Similar Articles:

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel