Account Login

Don't have an account? Create One

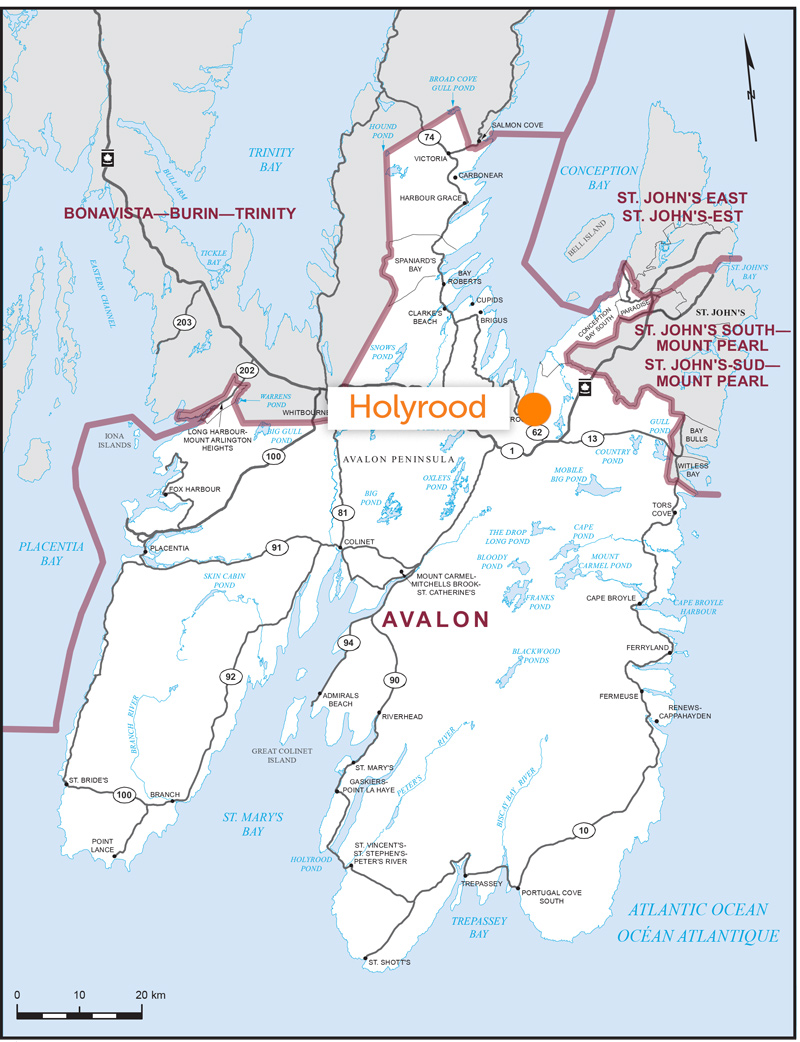

People living and working in the Town of Holyrood may not be aware but the federal government has been putting a lot of thought into whether or not they’re in a “rural” or “urban” setting. The label is directly tied to Climate Action Incentive Payments (a.k.a. carbon tax rebates). The area is part of the federal riding of Avalon, represented by Liberal MP Ken McDonald.

In April 2024, a moving federal marker meant people in Holyrood, a community of roughly 2,500 people about half an hour’s drive from St. John’s, was set to shift from a “rural” to “urban” designation. The change would mean reduced carbon tax rebates, as people would no longer receive the slightly larger rebate offered by the federal government to residents of smaller and more rural communities.

However, that loss is now on hold, at least for a couple of years, assuming the Government of Canada follows through on changes announced at the end of October.

The announcement by Prime Minister Justin Trudeau drew significant attention nationally, mainly for his commitment to carve out taxation applied to home heating oil deliveries, long sought by McDonald as well as Newfoundland and Labrador Premier Andrew Furey and other Atlantic Canadian premiers and MPs. There was also some attention paid at the time of the announcement to a planned doubling of the “rural” top-up on the carbon tax rebate. The supplement of 10 per cent additional payment for rural vs. urban taxpayers is scheduled to increase to 20 per cent. Less attention was paid to another change: a pause on any changes to the areas given a “rural” designation across the country.

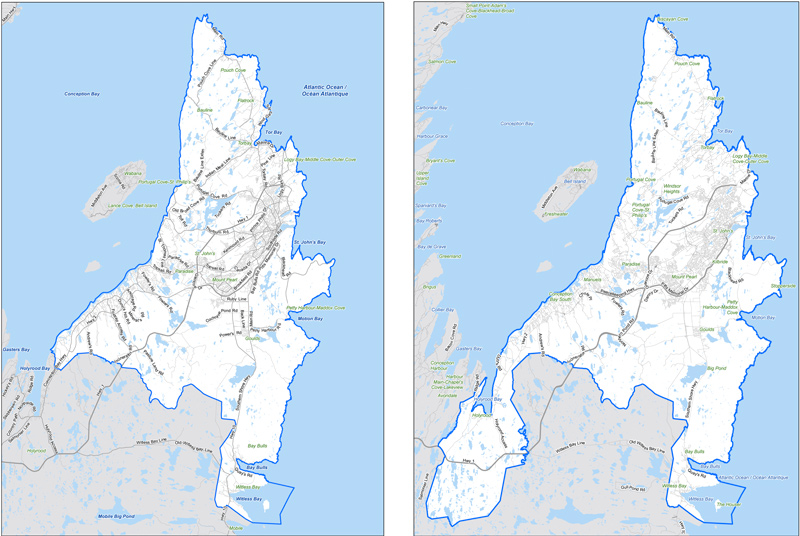

The rural top-up is only issued to people living outside of what is called a Census Metropolitan Area (CMA). CMAs as a designation pre-date the carbon tax. These areas are determined by Statistics Canada based on population counts. They’re outlined for various practical purposes for things like regional and comparative analysis, as well as quantitative insights into the lives of Canadians. In provinces with smaller populations and lower population densities like Newfoundland and Labrador or Nova Scotia, there is just a single CMA. When the carbon tax was created, it was decided CMAs would be used to divide “rural” and “urban” taxpayers. In Prince Edward Island, where there is no CMA, all residents are deemed to be “rural.”

As of Census 2016, the Town of Holyrood was not included in the Newfoundland and Labrador CMA. Unfortunately for local taxpayers, as of Census 2021, it was moved into the CMA. The change—prior to Trudeau’s announcement—meant Holyrood residents faced receiving less in carbon tax rebates beginning April 2024. However, after the Prime Minister’s announcement, the payments will now be issued per the old, 2016, CMA boundaries through the 2024-25 and 2025-26 fiscal years.

Staff with the Canada Revenue Agency told Atlantic Business Magazine in an emailed response to questions that, assuming the changes announced by Trudeau receive Royal Assent, Holyrood residents can expect to keep their higher rural payment and receive the added rebate all rural recipients get with the announced increase to a 20 per cent premium.

Holyrood Mayor Gary Goobie said in a brief phone interview he had not heard anything about a pending change in status for the town’s residents when it comes to the federal tax rebate. He said the town has been part of a municipal-level initiative, discussions on a new Northeast Avalon Regional Plan, where it has participated in talks for planning purposes alongside what he considers urban municipalities. “But technically Holyrood is still a rural community,” he said. He also said the issue of carbon tax rebate changes “was never discussed” in any of his conversations with McDonald.

“Truthfully, while it was an issue I was aware of, it wasn’t something I was specifically lobbying for ….”

—Ken McDonald, MP for Avalon, Newfoundland and Labrador

For his part, McDonald told Atlantic Business Magazine he wasn’t aware of the decision to keep the CMAs from changing, including the change that would affect Holyrood, before it was announced.

“Truthfully, while it was an issue I was aware of, it wasn’t something I was specifically lobbying for ahead of this announced change. I was focusing my efforts on supporting the ask from the Atlantic premiers to have the carbon tax on home heating fuels paused. I’m sure however that the department heard loud and clear from residents and local government in Holyrood that including them as an urban community was unfair and didn’t accurately reflect the geography of Holyrood at all. I don’t believe that was a political decision, rather than a decision to make a simple change in response to the concerns of people in the community,” he stated in an email.

For context, Holyrood is not the largest community in the Avalon riding. The firmly rural communities of Placentia, population 3,289, and Carbonear, 6,235, are larger towns in the same riding. The area also includes some of the fastest growing communities in the province, in areas closer to the capital of St. John’s (namely Paradise, at 22,957 people and Conception Bay South, population 27,168 as of Census 2021).

At this point, while application of the new CMA boundaries is (pending Royal Assent) on hold through the 2024-25 and 2025-26 fiscal years, the new boundaries would be applied in 2026. That’s assuming the carbon tax approach does not see further changes in the interim.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel