Account Login

Don't have an account? Create One

The National Angel Capital Organization’s (NACO) annual Report on Angel Investing shows Atlantic Canada took part in the 2021 recovery, when it comes to investment in entrepreneurial companies. Even so, Atlantic Business Magazine was told, new angel investor groups are needed going forward to help the region reach its full potential.

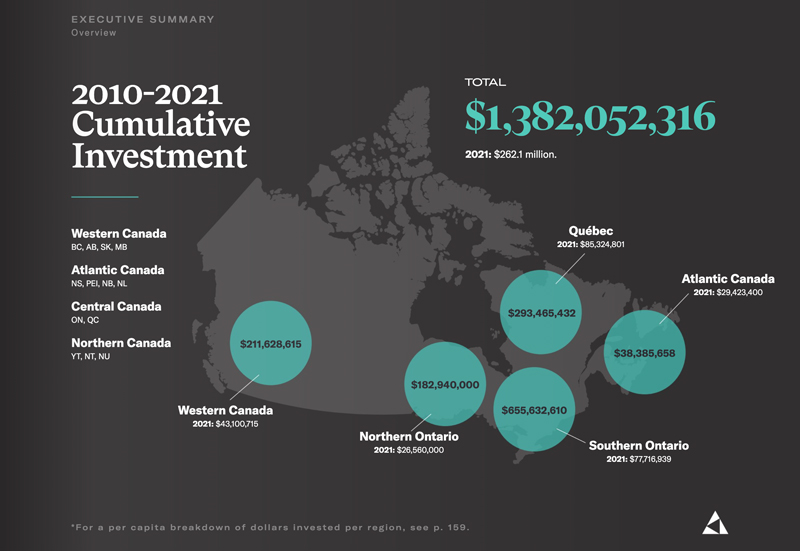

In all, 31 angel organizations across Canada reported data directly to NACO for the review, with publicly available information gathered and included from another 10 organizations. For the 41 investor groups, 635 deals were recorded nationally for 2021, or $262.1 million in investments in pre-seed and seed stage companies. It was an improvement over the previous year.

Sticking to only the direct contributors to the study, the number of investments was still up 22 per cent year-over-year and total value up 57 per cent, or what the organization highlighted as “significant recovery” from the onset of the COVID-19 pandemic.

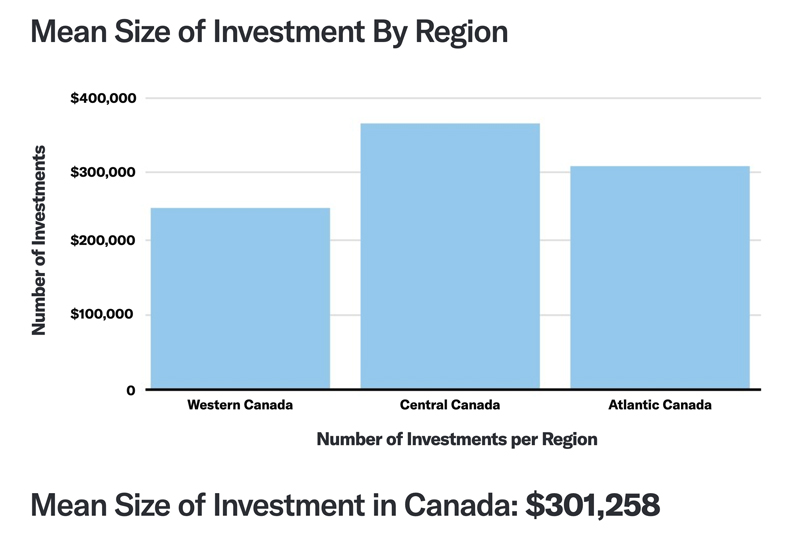

Atlantic Canada rode the wave, with companies based in the region landing five per cent of the 635 deals reported. Atlantic accounted for 12 per cent of the total value. When investment values were averaged, the region came out behind Central Canada but ahead of Western (at $377,000 mean investment for Central, $317,000 for Atlantic and $242,000 for Western).

“For the past four or five years, Atlantic Canadian startups have tended to raise angel capital in a range of about $22 million to $29 million each year, and the angel funding for 2021 was right in the middle of that band,” wrote Entrevestor principal Peter Moreira, in a section contributed to the report specifically on Atlantic. He stated Entrevestor research showed startups here hitting $26.8 million in 2021.

More companies launched (125 by Entrevestor’s count) over 2020, Moreira stated, but fewer than in 2019, pre-pandemic, with more failures seen. Ultimately, the startup community is growing more slowly, he stated.

“Atlantic Canada has tremendous potential. It has a cohesive, regional ecosystem with a lot of really wonderful people doing really amazing work. The challenge that we see is that entrepreneurs have very few access points to capital at the pre-seed and seed stage,” NACO CEO Claudio Rojas said in a brief interview, following the report’s release Wednesday, highlighting the small-but-mighty collection of venture capital firms but loss of First Angel Network. The network, based in Halifax, was founded in 2005 to funnel support from wealthy individuals to high-potential companies, to help them reach a level where they became more attractive to other private capital. The network shut down in 2019.

“Since the collapse of First Angel Network (…) there is absence of angel organizations for entrepreneurs to raise capital at the pre-SEED and SEED stage,” Rojas said, before crediting groups and funds including Island Capital Partners in Prince Edward Island, Killick Capital in Newfoundland and Labrador, the New Brunswick Innovation Fund, Innovacorp and more for “leaning in” and helping to direct founders who might otherwise have found a home with a regional angel investor group.

Rojas said NACO is also trying to help fill the gap and is collaborating with members nationwide to improve connections between accelerators and investors, and between entrepreneurs in Atlantic Canada and sources of funding and potential partners in other parts of the country.

He encouraged Atlantic Canadians to leverage the ecosystem and stay steady.

“I think what we’ve seen is that great founders are in all parts of the country, and they don’t just reside in dense urban centres. In Atlantic Canada we’ve seen this with Verafin. In a small population even within Atlantic Canada out of St. John’s, Newfoundland (and Labrador), we saw a $2.75-billion success story emerge,” he said. “Verafin is an extraordinary success story in terms of the ability of founders to build companies in low population parts of the country but leveraging national connectivity, national relationships, national customer networks. It’s been extraordinary for St. John’s and for Atlantic Canada for that matter.”

Canada has been hit with some of the contraction seen in available venture capital globally in 2022, the report warned.

The next edition of Atlantic Business Magazine (The Innovation Issue, Nov/Dec 2022) will feature advice gathered from venture capitalists in the region on how founders and companies here can best approach and pitch venture capitalists in 2023 and beyond.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel