Account Login

Don't have an account? Create One

First in a nine-part series

Let’s kill the hydrogen hype. Atlantic Canadians need to become hydrogen realists if they want to understand the true prospects and challenges for new wind-hydrogen-ammonia and related heavy industry here, both now and into the future. Atlantic Business Magazine offers this special series with that in mind. It represents a base for further reporting to come, as hydrogen projects proposed in the region are pursued.

For starters, it’s uncertain how much demand for hydrogen is coming, locally and globally, or how fast demand for specifically “green hydrogen”—hydrogen made using a process called electrolysis and without fossil fuels—might emerge. Government policies linked to climate change are transforming energy markets; a flood of new capital into research and development globally is affecting available technologies and end use products; a similar rush of cash is helping to build production facilities for hydrogen and related products. There are forecasts on what will be needed, where and when, but these are wide ranging and rife with caveats.

Hydrogen 101

Demand comes from use. From a technical standpoint, hydrogen can be used for many different things and very few, if any, are entirely new to us. Scientists were producing hydrogen before they ever knew what it was. English physicist Henry Cavendish is credited with its “discovery” in 1766, recording it as a distinct element. Researchers have explored its forms and various uses ever since. A new hydrogen “father” was christened every few years from Cavendish’s time, through discoveries and progressive invention around the world. William Nicholson and Anthony Carlisle were said to have fathered electrolysis in 1800, making hydrogen; Christian Friedrich Schoenbein is credited with the idea of the “fuel cell effect,” using hydrogen for the production of an electric current; William Grove was dubbed father of the fuel cell itself after his actual demonstrations of the same.

Eventually, there were the first hydrogen-filled balloon flights, capitalizing on hydrogen’s lightness and demand for space. The first non-stop, trans-Atlantic crossing with a hydrogen airship came in 1919. Beginning in the 1920s, German engineer Rudolf Erren developed the Erren engine and he went on to put hydrogen-based power systems into trucks, buses and reportedly at least one U-Boat (though there were time limits on Atlantic Business Magazine’s wander down the rabbit hole here). In 1943, hydrogen was tested as a rocket fuel, then fuel cells came into play in stronger power packs, becoming part of the space race. Closer to home, the Allis-Chalmers fuel cell tractor was used to plow a field in the United States in 1959, before demonstrations of hydrogen-powered welding machines, forklifts and golf carts. Hydrogen-powered fuel cell cars received attention with prototypes in the 1960s and 1970s. The takeaway from all this? The basic idea of hydrogen being put to use, being able even to power things, is an old one.

In starts and fits of research over many years, fundamentals applicable to commercialization of different end uses became clear. For one, the space pure hydrogen requires is a challenge for any transport via a container where space is at a premium. If considering hydrogen as a fuel, hydrogen is lighter than other fuels but likes to take up space.

In hard numbers, comparisons between fuels are often expressed in an energy value, referring to the amount of heat released from combustion of a particular amount of fuel, specifically the “higher heating value of megajoules per kilogram” or “MJhhv/kg.” In technical terms, the “gravimetric energy density” is the amount of energy carried per unit of weight, where hydrogen bests fossil fuels. Liquid hydrogen has a gravimetric density around 142 MJhhv/kg H2, or about 3.1 times higher a value than diesel. Hydrogen is nice and light. However, it has poor “volumetric density” of around 38.3 MJhhv/l, demanding more space, making it not so easy to bottle up. And we know that to move hydrogen in a liquid state, it has to be kept chilled to minus 253 degrees Celsius, far colder storage than even natural gas.

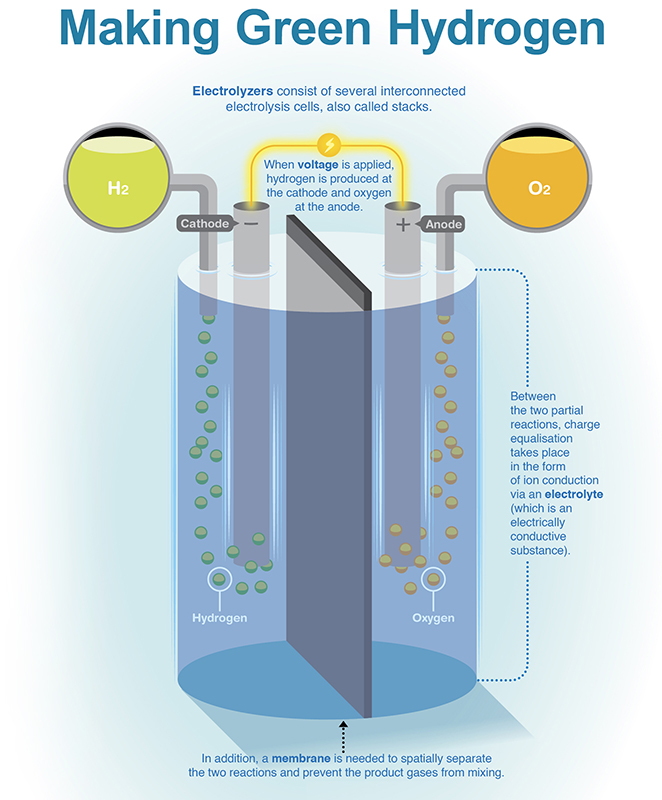

Hydrogen can exist naturally but for practical, mass use, it needs to be manufactured. A challenge relevant to climate change is that almost all of the hydrogen we currently make and use on the planet—over 95% by all counts and reportedly as high as 99% just five years ago—comes from processes reliant on fossil fuels. Steam-methane reforming is the most common way of making hydrogen, where steam at high temperatures (700-1,000 C) and natural gas (as a source of carbon-rich methane) react with a catalyst under pressure. The end product is commonly called “grey hydrogen.” The “green hydrogen” to flow from heavy industrial developments proposed for Atlantic Canada is made through a process called electrolysis. Electricity made from renewable energy is applied to water to separate it into hydrogen and oxygen, without any direct fossil fuel emissions. The Government of Canada and producers are actively trying to move away from the colour labels, saying the focus is intensity of greenhouse gas emissions (GHGs). For example, if it’s made by tapping fossil fuel power, green hydrogen wouldn’t be “green” in that it would actually cause greater emissions. They’d simply be from the power plant instead of the hydrogen facility. Regardless, if production is fed electricity as expected (ie. renewable power to “green” projects), the colour code stands as a commonly referenced way to separate producers using renewable power and electrolysis from producers reliant predominantly on natural gas. With that in mind, you will see colour references in this series. The federal government has incentivized the retrofitting existing hydrogen production facilities in an attempt to capture emissions at the point of the production of hydrogen and derivatives (like ammonia) made using fossil fuels. This proposed production with carbon capture has been described as “blue” hydrogen.

As Canadian Natural Resources Minister Jonathan Wilkinson told the Globe and Mail at the Canadian Hydrogen Convention in Edmonton last year: “In the short term, we need to do everything we can to drive down the carbon intensity of hydrogen that’s derived from natural gas (being blue hydrogen), because it is significantly more cost effective.”

The U.S. is also financially aiding proposed blue hydrogen projects. And though the cost of explicitly green hydrogen will come down, the build-out of blue hydrogen is expected to be enough to drive new natural gas demand globally in the coming decades. Many people are watching to see where the business of hydrogen runs up against the essential need for rapid cuts to fossil fuel use.

Hydrogen hype

Canada has committed to slashing GHGs by 30% below 2005 levels by 2030, under the Paris Agreement, and to achieving “net zero” GHGs by 2050. That means effectively offsetting any emissions left through projects meant to remove emissions like carbon dioxide from the atmosphere. Reaching those goals means a snappy pace in changing our energy systems. It means rapidly reducing and ultimately largely ending the free burning of fossil fuels. All of that is why hydrogen is in the spotlight. In a rudimentary-level concept, electricity made from renewable power can be substituted for fossil fuel energy. Green hydrogen can be a carrier for renewable electrical power, as you reach beyond the wires of existing electrical systems.

Climate change disasters have helped to turn the tide of majority public opinion, when it comes to governments taking more aggressive and expensive action to slash GHG emissions. People are also seeing possible new business opportunities in the transition. Whether or not they are right or wrong in their beliefs is a question separate from the fact there is movement.

One of the problems with talking about hydrogen projects right now is much of the response to public questions has been coming from people in “a position of either moral hazard or outright conflict of interest,” as chemical process expert and Hydrogen Science Coalition co-founder Paul Martin told Atlantic Business Magazine. The Hydrogen Science Coalition is a not-for-profit collaboration by scientists with a desire to confront hydrogen misinformation.

The Coalition would like to see more circulation of basic facts and, if needed, independent analysis for governments on hydrogen-related business (and that’s not a pitch for consultancy work, as Martin says Coalition members don’t take related contracts). Martin said he’s heard, for example, descriptions of hydrogen as a wholesale, one-to-one replacement for liquified natural gas when, “nothing is the new LNG.” You can’t simply swap out one fuel for another in an existing pipeline, and you can’t repurpose all the existing LNG infrastructure. In fact, he said, hydrogen has a long list of related considerations and infrastructure costs often not incorporated into overly positive discussions.

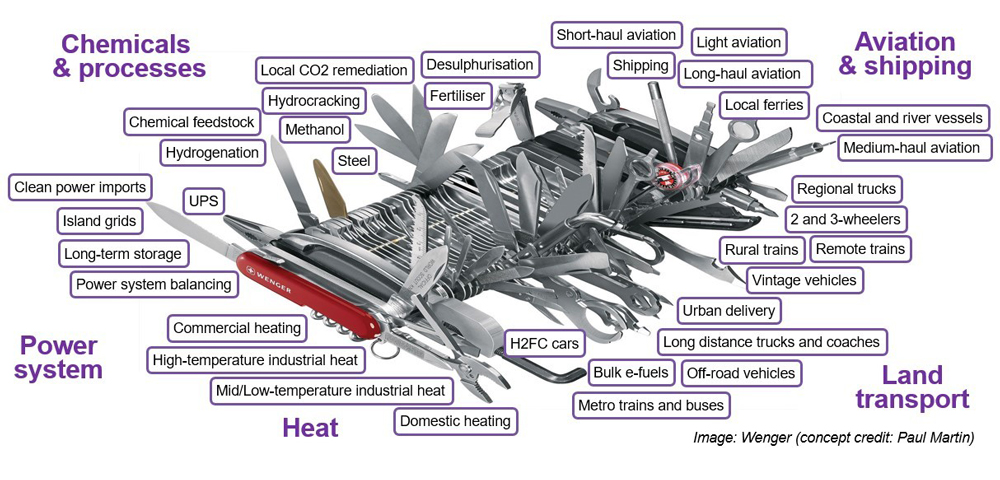

With the world struggling with climate change, he said people are often looking for a saviour product—a thing that can be held up as an answer to many or all related troubles. But there is no magic answer. Hydrogen has repeatedly been described as the “Swiss army knife” for meeting future energy needs. When recently releasing the American hydrogen strategy, for example, U.S. Energy Secretary Jennifer Granholm told reporters clean hydrogen is the “Swiss army knife of zero-carbon technologies.” Martin refers to the image, but not in the same way.

What people often fail to see or acknowledge, he says, is that just because you can use hydrogen for something doesn’t mean it will necessarily be the best option, be efficient or competitive, or even reasonable. “It’s very much like a Swiss army knife in that if you had the real tool, you’d never reach for the Swiss army knife,” he said.

There is also competition to consider in assessing potential demand for hydrogen. Electric-battery options are not just coming on strong, they’re leading in many categories of energy end use where fossil fuels are being displaced.

Energy outlook details

For would-be producers in Atlantic Canada, there’s direct competition in hydrogen sales to consider. There are existing producers of hydrogen and ammonia (manufactured using hydrogen) who may opt to grow and other emerging producers all around the world. The world’s largest energy companies and consultants are seeing others leading the way in feeding new demand internationally. Proponents locally say they can be part of the supply mix. Martin is on the list of skeptics.

“Let’s say instead of spending a million and a half dollars on a megawatt worth of (hydrogen) electrolyzer in Nova Scotia or Newfoundland, you put it in Western Australia or Chile. In both those places, they happen to have this wonderful situation where there’s a desert to the west of an ocean. And what happens then is that you know you get this beautiful solar electricity during the day, and solar is cheaper than wind. And then every night as the sun goes down, the land cools down, the wind blows in off the ocean. So you get this perfect match between wind and solar,” he said, offering an example of what could compete with our often-mentioned raw wind power. The “capacity factor” of the renewables used to power manufacturing facilities are a big consideration. Each project proponent will have to speak to their individual project’s competitiveness.

More generally, Martin disagrees with headline-grabbing numbers from global outlooks that tend to be dropped into speeches and presentations on hydrogen offered in Atlantic Canada, often without details relevant to the local outlook. For example, McKinsey & Company released Hydrogen Insights 2023 earlier this spring, its latest round-up of all things hydrogen for the international Hydrogen Council. It highlights more than 1,000 hydrogen projects around the world, representing an estimated $320 billion in direct investment between now and 2030, with about $46 billion in North America. Sounds like a party. What’s less likely to be picked up for mention is the fact local “early mover” status is disappearing, or that blue hydrogen, made using natural gas, stands out in the planned investments for North America.

“The value chain for low-carbon hydrogen production is more mature than for renewables, and the projects tend to be larger. Additionally, the deployment process is faster when retrofitting existing steam methane reforming facilities,” McKinsey stated. Locals might describe themselves as standing out with green hydrogen proposals, serving markets demanding the lowest-emission product, but green-blue competition exists.

BP’s latest outlook on hydrogen highlights the “blue” versus “green” battle for hydrogen market share. The company is forecasting only about 60% of their joint piece of the global energy pie in 2030 will be served by specifically green hydrogen. By 2050, the assumption is green hydrogen still holds only about 65% of the split. Again, that’s not share of global energy demand, or even total hydrogen demand, just the expected hare of the “low-carbon hydrogen” demand.

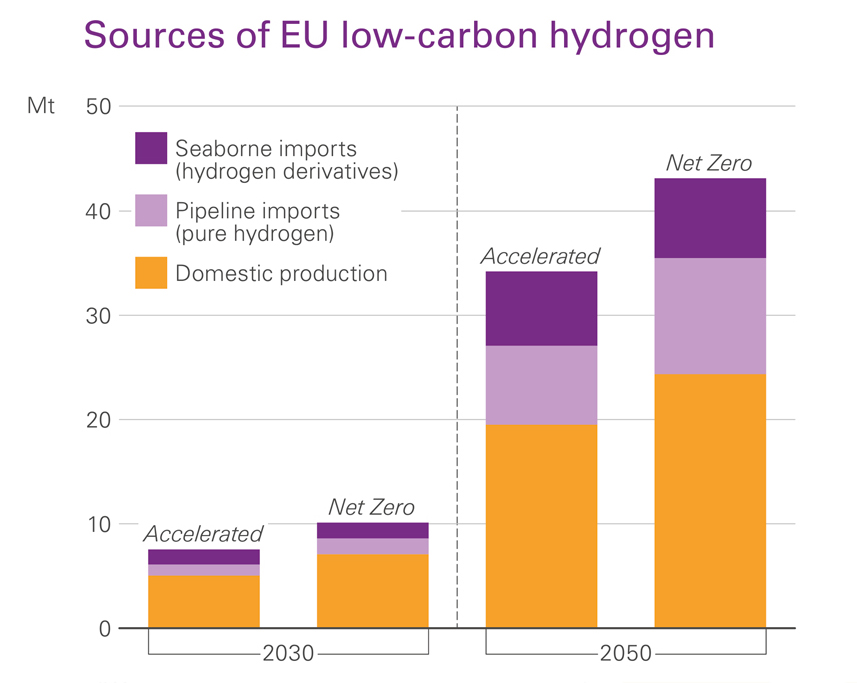

The company expects the European Union will self-produce around 70% of the low-carbon hydrogen (green and blue hydrogen) it uses in 2030, dropping to about 60% by 2050. It’s possible companies in Atlantic Canada could feed into the E.U. long term, but not a given. Further to BP’s image of the future: “Of the low-carbon hydrogen (the E.U.) imports, around half is transported as pure hydrogen via pipeline from North Africa and other European countries (Norway and the U.K.); and the other half is imported by sea in the form of hydrogen derivatives from global markets.”

That last bit could include us.

One product made from hydrogen is ammonia, and “imported by sea” theoretically could include a supplier setting up in Atlantic Canada, but that’s if it can compete with any others attempting to sell into that segment of the European market. Based on public pitches to date, almost all of the projects in Atlantic Canada are ammonia export projects, eyeing Europe and Asia.

Deloitte has an outlook that might sadden some. Looking at 2030, this region doesn’t show expected exports to Europe from North America, though some is mapped by 2050. Globally, the consultant expects regions in the Middle East, North Africa and Australia to become the top three areas shipping out hydrogen and related product supply to international markets. “These three big exporters concentrate nearly 90% of global hydrogen trade by the end of this decade. On top of their significant clean hydrogen supply potential, these regions are geographically well-placed to serve the growing demand of major close-by demand hubs: China, Europe, Japan, and Korea. North Africa is ideally placed to help serve the growing European demand,” it states.

It adds: “Regions such as North America should address domestic markets first before turning more extensively toward exports.”

‘Extremely uncertain’

Speaking at the St. John’s Convention Centre just a couple of weeks ago to members of EnergyNL, Rystad Energy’s senior vice-president of analysis, Claudio Galimberti, said it’s important to keep in mind “green” hydrogen is an emerging market more than an existing one.

“So far, the demand is basically zero; so we need to be mindful of that. There are a lot of prospects for the foreseeable future and long term, but we need to be mindful the future markets still need to be developed,” he said.

A key question is not just the speed of the energy transition, but at what rate the demand for green hydrogen might materialize and grow. And there’s no answer that can be given with certainty. If you go out more than five years, the view is “extremely uncertain,” Galimberti said.

Energy companies, associations and private consultants are all forecasting some base level of new demand for hydrogen. Accepting that, the next key question is whether or not green hydrogen will compete with hydrogen (or related products) made using fossil fuels.

Galimberti mentioned the support for blue hydrogen projects in the incentives within the U.S. Inflation Reduction Act (IRA). “The IRA contains a lot of provisions that make blue hydrogen a very important proposition. So that is something we need to bear in mind as the future of the hydrogen economy develops,” he said.

In terms of demands at home, companies proposing new green hydrogen production in Atlantic Canada may still find themselves in competition, with hydrogen producers in Quebec, Ontario and at old and new production facilities out West with plans to grow.

New industry and jobs

Each year, the Canadian Hydrogen and Fuel Cell Association offers a profile of the hydrogen sector in Canada. The profile for 2022 was developed by MNP for the association and based on survey responses. The consultant approached 305 organizations associated with hydrogen and fuel cells in the country, with 105 responding. Of the 105, not every company answered every question, but about 57% of the respondents reported on their revenues from hydrogen and fuel cell activities, with a total of $527 million in revenues. Looking at the 20 years prior, the association’s survey has never reported more than $400 million in revenues, with as low as $97 million reported in 2001. That’s revenue, not profit. Painfully, that’s compared to total oil and gas revenue in 2021 of $174 billion, according to Statistics Canada. And yes, that’s “million” for one, “billion” for the other. That’s not to say Canada doesn’t need to move away from oil and gas, just an idea of where we are.

The revenues could also be also set against the $5.6 billion over five years in cost to the federal government for the Clean Hydrogen Tax Credit, or the hope for new green hydrogen projects to bring jobs to economically depressed rural communities. In Atlantic Canada that often means areas that would otherwise only be strained by the energy transition.

“As the lowest carbon fuel, hydrogen is essential to decarbonizing the top third of Canada’s most energy intensive and hard-to-abate end-use applications, and there is much work to do to roll out hydrogen at scale domestically,” stated Canada’s national strategy on hydrogen, released at the end of 2020.

The Government of Canada was tutted by federal Commissioner of the Environment and Sustainable Development Jerry DeMarco in 2022, after an audit of that high-level hydrogen view. DeMarco and his team found big gaps between the speed and level of hydrogen uptake described in the strategy and, well, reality. Among other things, it estimates hydrogen could lead to more than 350,000 jobs and direct annual revenue of over $50 billion by 2050. It suggests the country moving from 3 megatonnes (Mt, or three million tonnes) of hydrogen production in the country as of the early 2020s to 4 Mt of production in 2030, to a whopping 20.5 Mt of potential production in 2050. But DeMarco reported the departments had “unrealistic assumptions” in their modeling of hydrogen uses and emissions cuts. When experts look at possible energy futures, they tend to go for ranges and model different scenarios. They look at cases where change is quick and far reaching; and they consider less aggressive change over time. DeMarco reported Natural Resources in particular prioritized “transformative” paths over incremental change. He reported the department assumed pro-hydrogen policies being in place, or rapidly adopted; assumed rapid uptake in hydrogen end use; ignored some of the supporting infrastructure needs and assumed “unrealistically low” costs for hydrogen production.

A glaring example of an assumption included was in the annual sequestration of carbon dioxide and equivalents (following capture of emissions), being a challenge for blue hydrogen producers. The hydrogen strategy assumes a 34 times increase in carbon sequestration by 2050 (from 4 Mt at the time of the audit to 135 Mt of sequestration in 2050). The strategy also assumed a level of blending of hydrogen with natural gas for some gas networks, in the near term, that could have been technically feasible but was not justified economically.

In tempering the outlook, DeMarco stated governments need to systematically consider how the electricity grid will handle renewable power demands for green hydrogen production; consider the cost effectiveness of hydrogen versus alternatives; evaluate when hydrogen-based machinery might be deployable at scale; consider how things scale up, including how people might try to manage their costs in the move off of fossil fuels. It’s decent advice for everyone.

The next installment of this series will look more closely at the hydrogen-ammonia prospects in Atlantic Canada, plus who is finding interest in their proposed supply.

Atlantic Business Magazine’s “Hydrogen Horizon” series is a high-level, moment-in-time look at the potential of hydrogen and its associated industry for Atlantic Canada. The level of demand for hydrogen production and the ability for Atlantic Canada to site competitive projects and service the markets, in a rapidly changing global energy sector, deserves serious and continuous evaluation.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel

This is a fantastic look at this emerging sector. I fear that the transmission grid will limit Atlantic Canada’s ambitions in the production of green hydrogen and its overall decarbonization process. Interregional transmission development can help Atlantic Canada move low-cost wind-generated electrons to power-hungry, neighboring markets during times of surplus, but also backstop intermittent local resources and buttress local supply during periods of high demand on the grid. The added side benefit of interregional transmission development would be more reliable access to power for hydrogen electrolysis. US officials are increasingly open to collaboration with Canadians on this front. It’s time for Atlantic Canadians to launch a new form of grid diplomacy with their neighbours.

covered everything except basic thermodynamics. that is the key physical fact missing from the hype. suggest reading Michael Barnard’s extensive coverage of the issue. the math isn’t that hard. if one wants one month of energy or of hydrogen, three months of energy had to be put in. how is that common sense energy policy? it’s not obviously because no one is doing their homework and considering simple energy calculations. the hype is a massive waste of money, time, and opportunity.