Account Login

Don't have an account? Create One

Second in a series of 9

Hydrogen is not a magic answer for all energy woes. Beyond that, it is being put to use more as the global energy transition continues, growing the market. As a result, companies have been kicking the tires on possible new wind-hydrogen-ammonia developments globally.

In Atlantic Canada, just because something has been mentioned as an idea is no indication of how close companies are to development, such as settling partnerships, securing land, pinning down a port if needed, completing environmental review, landing enough in purchase agreements (“offtake”) to get financing and to complete the work of financing construction. The basic details are not available to the public in every case just yet. That includes details on consultation plans, planned sources of renewable power, scale of new power generation needed, power lines and storage systems, electrolyzer capacity (needed for hydrogen production), scale of ammonia production, means of shipping, estimated costs and timelines.

A few projects are further along. Atlantic Business Magazine featured some in the pages of its January-February issue, though it’s worth updating. As of now, two proposed hydrogen developments in Nova Scotia have completed environmental assessment (EA) for the first phases of construction. Only one project has started the process in neighbouring Newfoundland and Labrador. More registrations are expected for the island of Newfoundland in particular, once provincial Crown lands are awarded through an ongoing “land sale” process for leases, and companies come to know how much area they have to work with and how many wind turbines they might be able to site in the near term. An announcement is expected on the lands any day now. Formal land leasing comes once a company can successfully navigate the environmental review process. Even with environmental assessment, companies will then need to settle details around things like electrical connections to the local grid, through reviews by provincial energy regulators.

The most advanced proposals in the region, at this point, based on available information and review processes, are found in the Canso Strait, N.S., the Eastern side of Placentia Bay, N.L., the Bay St. George area on Newfoundland’s west coast, and at the Port of Belledune and Irving refinery in New Brunswick. Atlantic Business Magazine is tracking projects and will have more in print this fall.

Cape Breton and the Canso Strait, N.S.

EverWind Fuels has completed an environmental assessment and received approval for the first phase of a proposed ammonia export project, one of several proposals for such projects clustered in the Canso Strait, running between Cape Breton and mainland Nova Scotia. This stretch has history with heavy industrial work. There is an active paper mill, an old coal power plant and marine industrial terminal with fuel storage experience along the coast.

The first phase of the EverWind project is expected to produce about 200,000 tonnes of ammonia a year. That is fed hydrogen from a proposed production facility with a 300-MW electrolyzer capacity. The hydrogen plant, as proposed, has a roughly 3.3 hectare footprint, while the ammonia plant covers about 1.6 hectares.

To feed the European market, EverWind plans to meet the “renewable fuels of non-biological origin” (RFNBO) rules for green hydrogen production. It requires suppliers to have power purchase agreements in place with renewable power suppliers, guaranteeing their hydrogen and ammonia production doesn’t require fossil fuels. The plan is for mainly onshore wind to fuel hydrogen production and ammonia exports by 2026, with that production made possible by new wind power capacity.

“All of the power that the EverWind project will use to produce green hydrogen will be contracted under renewable power purchase agreements that will comply with the requirements under EU law to qualify for RNFBO production,” an EverWind spokesperson told Atlantic Business Magazine, when asked about initial power sources.

As local news outlets, particularly Joan Baxter at the Halifax Examiner, have pointed to, the power source is an ongoing consideration, and something being watched closely. Apart from the company’s needs to assure a power supply based in renewable energy, there are pre-existing needs for more renewable power on the Nova Scotia grid. It’s a province where coal plants still supplied more than 40% of the power last year. It sets up a possible future where the company is without the renewable power it needs or is getting what it needs while the surrounding communities are not. As the Examiner reported, even by 2030, Nova Scotia Power still only expects 80% of its electricity to come from renewables.

The details of production, of the relationship to local energy grids, is an issue being discussed around the world. There is the “additionality” consideration, where companies relying on pulling power from an existing grid to produce hydrogen and ammonia are using electricity that will then have to be covered by new “green” production for the grid yet to be built. And in the case of an area where grids still rely on power from fossil fuel plants, it could mean greater use of these fossil fuel-power plants, if renewable facilities are not going up to service all hydrogen and ammonia production needs. For green hydrogen projects, it may be possible to establish power purchase agreements with existing “green” grid suppliers in an otherwise dirty power mix, but that deprives the grid of that amount of green power. It potentially costs other grid users. In the case of the Maritimes, grid connections into other parts of Canada and the U.S. may mean pulling power from other jurisdictions similarly struggling to meet all needs, bringing in “regionality” as a consideration. Government and electricity regulators are back and forth in the U.S. over requirements around electricity for being declared green hydrogen and what kind of projects should qualify for incentives, based on power supply reviewed down to the hour. It is an area of active debate.

Ultimately, there is fear that—looking at total power needs—ramping up production at fossil fuel plants to meet hydrogen and ammonia production, paired with fossil fuel use in shipping, risks producing more greenhouse gas emissions, not less. EverWind is not the only company facing a grid with fossil fuel plants, trying to assure clean ammonia production. In its case, it says it will see, beginning onshore, new wind farms to serve its needs.

New, offshore wind development has been otherwise suggested as a means to further decarbonize in Nova Scotia and allow for hydrogen projects while also offering more electricity. Canada has so far lagged behind in getting regulations in place to allow for developments offshore. Ottawa and the provinces are still working to pass legislation that would allow for offshore “land sales” and wind power development, though it could be settled this year. The Government of Nova Scotia has announced an aggressive target of offering leases for 5GW of offshore wind capacity by 2030. EverWind has been clear on its interest in partnerships with offshore wind developers based on that timeline. But a “green hydrogen action plan” is also expected from the government and has the potential to further address the grid power concern.

EverWind has suggested it will build from 200,000 tonnes of ammonia production a year out to a suggested 800,000 or even 1 million tonnes of production by 2026. For now, a condition on its EA release in December 2022 is for the first phase of development to begin construction work within two years. The company wants to be producing in Nova Scotia in 2025.

EDITOR’S NOTE:

On July 17, EverWind Fuels announced three wind farm developments, designed with a total capacity of about 530 MW, to service the company’s project. The wind farms are being developed and built in partnership with Renewable Energy Systems Ltd. Two of the projects, one known as the Bear Lake wind development and the other the Kmtnuk wind project, are being developed with Wind Strength, under a partnership with the Membertou First Nation. Atlantic Business Magazine will have more in our next issue.

While it’s not the basis for the development, the company’s longer term expectations include some new, local demand for hydrogen and ammonia. “As our project develops, we plan to provide green hydrogen into the Nova Scotia market to help the province decarbonize, we expect that 10% of the volume will be able to be placed into the Nova Scotia market and hopefully more over time,” stated an emailed response to questions.EverWind has separately advanced plans since 2022 for a project in Newfoundland and Labrador, on the island’s Burin Peninsula. It’s suggested it would come with installation of a minimum of 2 GW of new wind power capacity. The company has been securing land through private arrangements and a filing into the Crown land process. That project has yet to see filing for environmental review.

Back on the Canso Strait in Nova Scotia, Bear Head Energy has a proposed project also already cleared through environmental assessment. The site neighbours EverWind’s development. The area was once being considered for a liquified natural gas export facility, before a new team and new concept emerged.

The hydrogen-ammonia project approved will be able to produce up to two million tonnes of ammonia a year, with the build out based on the availability of renewable electricity. In its filing for environmental review, the company said its plans are based on an average of 2,860 MW of power input, with 2,000 MW needed to run the electrolyzers to make hydrogen at full build out, another 860 MW needed for the ammonia production process. To put that total of 2,860 MW in context, according to the Canada Energy Regulator, Nova Scotia currently has a total electricity generating capacity of about 3,060 MW.

A third, possible project for the Canso Strait area, though much smaller, is being discussed by Quebec-based Charbone Hydrogen and Port Hawkesbury Paper. It’s at an earlier stage, with the companies still settling on “project definition,” meaning exactly what they will undertake together in detail. However, as a company, Charbone has been able to quickly advance elsewhere, focusing on pure hydrogen supply for markets near to smaller-scale production, rather than the added production of ammonia, methanol or other product for export. The company is building reach in both Canada and the U.S., and is promoted as the only publicly traded pure play hydrogen producer in North America. It has a green hydrogen plant under construction in Sorel-Tracy, Q.C., about an hour from Montreal and a development in Selkirk, Manitoba. Next is the possible project in Port Hawkesbury, while it is looking at other possibilities in Ontario, Alberta and at least eight locations in the U.S. Already, Superior Propane has agreed to distribute Charbone’s hydrogen.

Charbone Hydrogen and Port Hawkesbury Paper announced a non-binding memorandum of understanding (MOU) for discussions on a Port Hawkesbury project in June 2022, suggesting something more by end of that calendar year. The discussion period covered by the MOU was extended. Charbone chief operating officer Daniel Charette told Atlantic Business Magazine the companies are tentatively looking at a facility with a 1-2.5 MW electrolyzer capacity. It would use power from the grid, that the company says will be renewable and delivered as such under terms of a power purchase agreement.

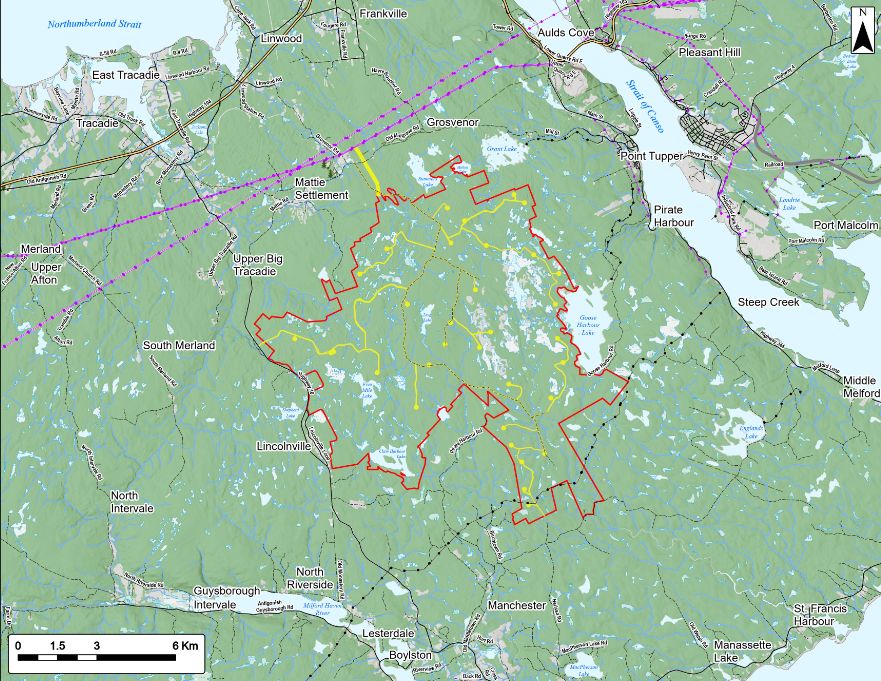

“There is enough renewable on the Nova Scotia Power Inc. grid to start the project, plus there is a biomass generator onsite,” he stated, also mentioning the 130.5 MW wind farm Port Hawkesbury Paper has proposed to build in a rural area in nearby Guysborough County, just across the Strait.

“The plan is to produce gaseous green hydrogen for the province market, use it to decarbonize industrial processes and mobility, and increase the size of the project as the market grows,” Charette stated.

The hydrogen project has not yet entered environmental assessment. The wind project, known as the Goose Harbour Lake Wind Farm, was approved in March. The stated purpose for the wind farm is diversifying the power supply for the paper mill.

Come by Chance and Placentia Bay, N.L.

Along the coast of Newfoundland, the area of Placentia Bay is poised to see a renewable fuels refinery emerging from a former crude oil refinery; there is an existing and separately managed heavy industrial port facility in the area, with plans to expand for shipping ammonia; and the possibility of the addition of wind-hydrogen-ammonia production both within the refinery property boundaries and beyond.

Braya Renewable Fuels is reworking the Come by Chance oil refinery into a biofuels refinery. It won’t be the first of its kind for Canada, with that honour recently going to a facility in British Columbia. However, the facility in Newfoundland and Labrador is set to be the largest of its kind in Canada. For comparison, the B.C. biofuels plant by Tidewater Renewables can produce 3,000 barrels a day, while Braya Renewables is expecting to produce 18,000 barrels a day of “renewable diesel” and other alternative fuels in Atlantic Canada, also looking at products like sustainable aviation fuels.

The Braya Renewables redevelopment project is already underway. Its completion was made possible when investors at Energy Capital Partners agreed to join Braya’s existing owners, Cresta Fund Management and North Atlantic Refining Corp., kicking in a $300 million equity investment. Then, at the end of May, the federal government came to the table with $86 million to support the redevelopment. Construction should finish this year. For comparison, the B.C. facility had a total estimated cost of just $380 million, according to the CBC.

Braya is also working with ABO Wind on a possible, multi-phased, wind-hydrogen-ammonia project that could provide hydrogen to the refining facility but also allow for export. At the recent EnergyNL conference in St. John’s, a presentation by ABO Wind’s head of business development Fabian Hinz suggested this hydrogen-ammonia project could start with a couple of hundred megawatts of installed wind production, then building out to 1,000 MW or more of power supply to allow scaling of hydrogen and ammonia production for export, targeting the German market.

If it sounds a bit loose, it may be because ABO Wind has completed some environmental investigations, the kind of data gathering needed for an eventual registration of a project for environmental assessment but is now looking to start a feasibility study. No one was hired for the study at the time of the Energy NL conference. Exactly what might be financially reasonable should shake out from there, with firmer numbers being included in the registration for environmental assessment in maybe 2024.

North Atlantic Refining Limited (NARL) is a minority partner in the refinery (the size of the stake is not public). Separate from the refinery property, there is the NARL Logistics Storage and Marine Terminal business in the Town of Come By Chance. It offers deep-water berths for tankers, crude storage and bunkering services. There are only a few existing import terminals for moving liquid fuels into the island, with North Atlantic offering a large facility. Speaking with Atlantic Business Magazine, NARL Marketing and Logistics president Ted Lomond estimated the company handles about two-thirds of all the refined fuels supplied to the island and “pretty much all” of the jet fuel. He said the company is looking to invest in the facilities, wanting to offer the means to move ammonia out, and at great scale. And that could be for more than one ammonia producer on the island.

Apart from that, there’s the potential for local sale of new products from the refinery or otherwise through North Atlantic’s retail footprint. North Sun Energy is the name on a partnership developed between North Atlantic and Suncor Energy, for the North Atlantic and Petro-Canada branded retail gas business in Nova Scotia, Prince Edward Island and Newfoundland and Labrador. It covers 110 gas stations. And beyond these stations, North Atlantic facilities are used to move bulk fuel shipments that could be flipped to biodiesel, ammonia and other products.

It should be said Newfoundland Transhipment Limited has an entirely separate business in the same area, running the Whiffen Head transshipment facility, handling crude oil from the offshore oil fields. Being in the same area, North Atlantic does supply fuel to run the tanker vessels.

Another possible hydrogen-ammonia development in Newfoundland is on the Argentia Peninsula, to the south of Come by Chance but also on Placentia Bay. The Port of Argentia’s property is a former naval base that includes a small peninsula, jutting out into the bay, but also more land, reaching in towards the nearby Town of Placentia. A drive from Placentia into St. John’s will take you a little over an hour. There are no formal links between the new and proposed operations in the Come by Chance area and the Argentia-Placentia concept, but the two are only about an hour’s drive apart, with Vale’s nickel-copper-cobalt processing facility tucked in-between along the same stretch. Proponents have given some thought to local subcontracting capacity and labour, so it’s worth mentioning all of this together.

The Argentia project involves a foray by well-known North American wind power provider Pattern Energy into the hydrogen-ammonia export business, in partnership with the port. The proposal being floated here, as there has been no registration yet for environmental assessment, includes at least two phases of development. The first would see 6,000 acres of the almost 10,000 acres of private and largely forested port land dotted with wind turbines. Both the hydrogen and ammonia production facilities will be established to match in the existing, active industrial area of the port. For anyone familiar with the facility, the ammonia plant is planned to go just in front of the old military runway, not quite out to the area currently being used to build the concrete gravity structure, the base, for the West White Rose extension, an offshore oil project led by Cenovus. For the second and third phases of the wind-hydrogen-ammonia plan, wind turbines would be going up beyond the port’s footprint, into the surrounding area of Placentia Bay, with need to secure Crown lands for the needed wind turbines before any build out.

But the starting point is within the “fairly huge asset” of the port property, as Pattern Energy’s director of green fuels business development Erika Taugher described at the Energy NL conference. The private land is also the key to the expected speed of the initial development. The company was targeting first hydrogen production for 2025 but, Taugher said, “I think it’s looking more realistically like 2026.” The company has been busy with the details, including a decision to move up from what initial thinking suggested would be 200 MW of wind power to start, to instead have 300 MW in the first phase, given further engineering work.

Port of Argentia CEO Scott Penney said the port’s forested area was “a buffer” intentionally created between the military site and the Town of Placentia. It won’t be clear cut for the wind turbines going in, he said, though an area of “a couple of acres” will be cleared for each turbine and a service road built to connect the turbine sites for servicing. And as for space in the industrial area, Penney said the sheer size of the facilities will allow for the port to continue to offer laydown services for companies building offshore wind in the United States (the port has gained needed revenue in recent years offering a holding service for monopiles—wind turbine foundations—coming from across the Atlantic and destined for offshore wind farm installations). The space will be less once the hydrogen and ammonia production facilities are built, he said, but the port was working with about 140 monopiles when Penney spoke to Atlantic Business Magazine, and he said roughly it could handle maybe 90 after the proposed construction.

“It’s not going to be a showstopper for us,” Penney said of the change, already communicated to port users like Boscalis, emphasizing the benefits from a commercial partnership established with Pattern Energy for ammonia production and exports would outweigh the laydown business.

In concept, the port receives benefit from the project and the town would receive new revenue in turn. “Placentia gets 20% of our gross revenues. So, if we’re bringing in $30 million a year now in new revenue, in gross revenue, from this project, then that’s six million bucks going to the town,” Penney said, as a hypothetical example. “That helps with their roads, it helps with the new swimming pool that they’re building here and other infrastructure, so it’s a win-win,” he said.

The port’s commercial agreements backing the new wind-hydrogen-ammonia project are actually with Argentia Capital Inc. The latter is a private, 50-50 partnership between Torrent Capital and the port corporation, facilitating an equity partnership with Pattern. The joint entity Argentia Capital is chaired by former Newfoundland and Labrador premier Dwight Ball. The exact terms of the project arrangements, from berthing charges to land lease rates, have not been publicly disclosed.

As part of the ammonia export plans, the port is working on a proposal for a $100-million extension to its existing marine infrastructure. “We’re working with the federal government and provincial government and stakeholders,” Penney said, adding there wasn’t much more he could say at this point, but perhaps “in the coming months.”

Also in the Placentia Bay area, Brookfield Renewables’ subsidiary Evolugen is looking at developing a 250-MW wind farm. The power would, in concept, feed hydrogen and ammonia production, with about 200,000 tonnes a year of ammonia produced for export to the German market. The company has Crown lands applications in for land along the coast. While there is no mention of the project on the company’s website and no indication readily available of where the Crown lands are exactly, Brookfield Renewables’ senior vice-president and head of development Geoff Wright did present at the latest Energy NL conference on the overall growth in hydrogen demand, indicating some public consultation locally to date, and made the point the company is waiting for the results of the land sale process.

Stephenville and Bay St. George, N.L.

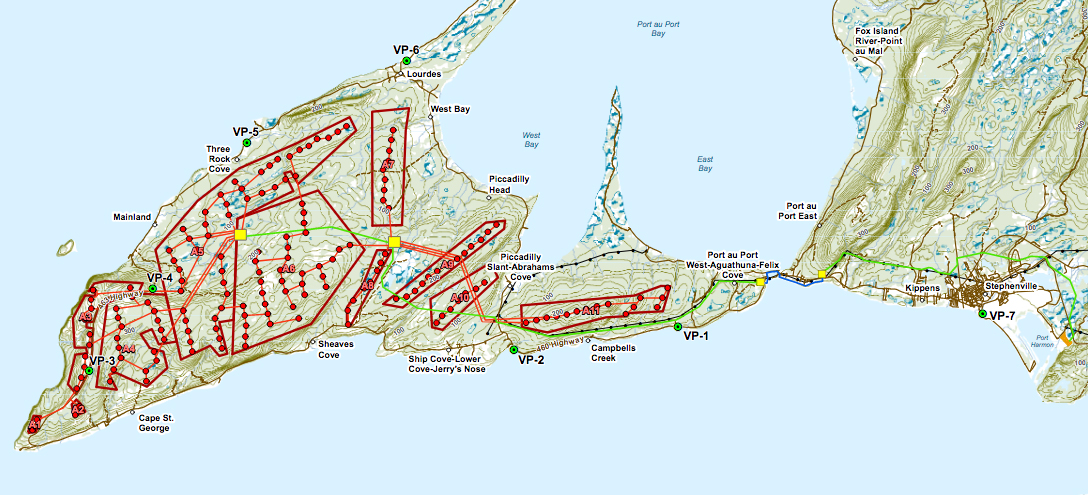

The first mover in Newfoundland and Labrador was World Energy GH2, with the Nujio’qonik Project. It is currently in environmental assessment. Beyond registration of the project for review, the company was asked to file a more detailed environmental impact statement (EIS) as the process rolls on. A spokesperson told Atlantic Business Magazine in May that the company was aiming to file the EIS in August (“date TBC”).

The company has targeted first hydrogen production in 2024 and is taking some knocks because it’s the first to go through some of the regulatory processes. For example, in working with local utility Newfoundland and Labrador Hydro on electrical demands. The very first bit of hydrogen production from World Energy GH2 will use grid power, not power from new wind farm developments, so one of the first pieces will be linking a hydrogen production facility to the local grid. “From what we understand of the process, this (grid) interconnection request will be evaluated after the Crown Land process is complete,” stated an emailed response to questions.

At the same time, the company will be building to reach its full phase one concept, with ammonia exports, adding wind farms to power both hydrogen and ammonia production.

“It’s an ambitious project in scale and speed, but projects like this are what is needed to have a meaningful impact in the fight against climate change,” said managing director Sean Leet, also presenting at the Energy NL conference.

More than kicking the tires, the company has an investment agreement in place with SK Ecoplant, part of sustainable infrastructure company SK Group, with the subsidiary taking a 20% stake in the first phase. On announcing the arrangement, in a press release, SK Ecoplant CEO Kyung-il Park stated: “Project Nujio’qonik has world-class wind, abundant fresh water, a deep sea port with close proximity to Europe, strong First Nations and community support, and support at all levels of government. Our investment in this project is a step toward producing first green hydrogen and ammonia in 2025 and taking a leadership position in the fight against climate change.” The signing ceremony for the agreement was attended by Canadian Minister of Innovation, Francois-Phillipe Champagne.

The level of community support has been questioned with some clear objections to wind-hydrogen-ammonia projects, World Energy GH2 plans and company actions to date. Representatives with the provincial government have stood behind the environmental review process. Some politicians have made a point to publicly say the objections to date do not represent a majority view. The formal review continues. It’s worth noting the projects in Nova Scotia cleared through EA also face objections.

The island’s west coast has also seen public consultations led by representatives of Fortescue Future Industries. That company has referred to plans for what’s been called the Lynx Project, in the Stephenville, St. George’s and Channel-Port Aux Basques areas. It has been suggested to offer between 700,000 and 900,000 tonnes of green ammonia a year, though has yet to be registered for environmental assessment.

Port of Belledune and separately the Irving Refinery, N.B.

If New Brunswickers feel their province is not receiving the same kind of notice in the East Coast hydrogen-ammonia scene, it’s because they’re not. A lot of proponents and companies interested in the sector are talking up Nova Scotia and Newfoundland and Labrador, but there’s an effort ongoing in New Brunswick to change the view.

The Government of New Brunswick has helped, including with things like a speech by Premier Blaine Higgs at the World Hydrogen Summit in Rotterdam, the Netherlands in May. Beyond general comments and the expected talk of things like small modular reactors for new nuclear power, Higgs plugged the Port of Belledune on the province’s northeast coast. Higgs was at the summit alongside officials from the Belledune Port Authority and Opportunities New Brunswick.

“New Brunswick is strategically positioned to be Canada’s energy gateway to Europe,” Higgs said.

New Brunswick may still be in the process of greening its grid, but the port is aggressively pushing part of its roughly 1,600 acres of industrial land as a “green energy hub,” with an agreement in principle with Cross River Infrastructure Partners for development of a hydrogen production facility with a 200-MW power requirement, plus plans for a “green energy hub” on port land. Port staff have similarly described New Brunswick, with its transport connections and still relatively close-to-Europe port as the perfect place for green hydrogen and ammonia production.

And on the other side of the province, there is the Irving refinery. Irving has gone public on a hydrogen project planned for the refinery, mentioned in further detail later in this series. It involves the addition of a 5-MW electrolyzer for the production of about two tonnes of hydrogen a day. The power for production will come from the New Brunswick grid, and the likely power demands were not included in a company release on the project. But the new hydrogen production at the refinery site is expected to be online by next year.

Many other companies have been out exploring projects but have yet to get firm or public on some of the details. Northland Power is said to be looking at an offshore wind-hydrogen project in Nova Scotia, for example. There’s Eastward Energy. A few, including Exploits Valley Renewable Energy Corporation (EVREC), Red Earth Energy Ltd. and Terra Nova Hydrogen in Newfoundland and Labrador have publicly shared ideas but not firm plans. EVREC has generally been the clearest for people, suggesting more than 3 GW of new wind to feed hydrogen-ammonia production in a two-phase build out, with construction perhaps starting at the end of 2025 and full operation by 2030, though with nothing further in detail on its website. None of the projects have registered for environmental assessment.

Atlantic Business Magazine’s “Hydrogen Horizon” series is a high-level, moment-in-time look at the potential of hydrogen and its associated industry for Atlantic Canada. The level of demand for hydrogen production and the ability for Atlantic Canada to site competitive projects and service the markets, in a rapidly changing global energy sector, deserves serious and continuous evaluation.

Comment policy

Comments are moderated to ensure thoughtful and respectful conversations. First and last names will appear with each submission; anonymous comments and pseudonyms will not be permitted.

By submitting a comment, you accept that Atlantic Business Magazine has the right to reproduce and publish that comment in whole or in part, in any manner it chooses. Publication of a comment does not constitute endorsement of that comment. We reserve the right to close comments at any time.

Cancel